The past 15 months have been challenging for businesses and property, with the coronavirus pandemic creating massive disruptions and losses. For insureds in the Mid-Atlantic region, which experienced a more active hurricane season than normal, those losses were compounded. As businesses reopen and prepare to resume pre-pandemic operation levels, it is essential to consider what interruptions severe weather may introduce throughout the year and how weather trends may impact insurance renewals.

Climate vs. Weather

Weather and climate are not interchangeable terms, despite common usage. Weather involves a specific set of conditions like rain, sun, temperature and humidity. Climate is the overall pattern of weather conditions in an area. Put more simply, weather changes daily. Climate evolves over decades, if not hundreds or thousands of years.

The term “extreme weather” has appeared much more frequently in the news media over the past 20 years. An analysis of The New York Times revealed less than 10 articles per year using the phrase “extreme weather” from 1850 through the mid-1990s. From the mid-2000s to 2010, the number of articles ranged between 25 and 50. Over the past ten years, coverage has risen dramatically to more than 125 articles on average.

While some of this rise in the usage of the phrase could be due to sensationalism, other factors influence its occurrence. Our ability to observe, monitor and report on weather, including extreme weather such as tornadoes, hurricanes, fires and floods, improved greatly through technological advancements such as weather satellites in the 1970s. Additionally, people have moved into coastal and flood plain areas in greater numbers, increasing the population and subsequent damage experienced when severe weather impacts those areas.

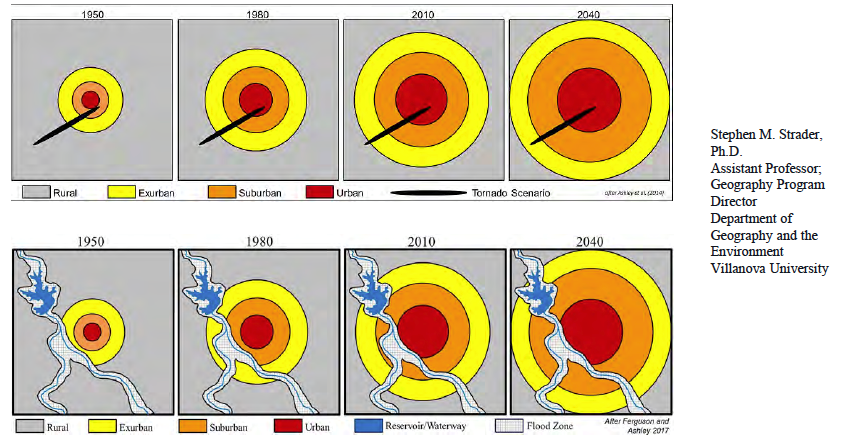

Humans and their possessions are becoming increasingly large targets for geographical hazards, as the image below shows. The black line represents a specific area where tornadoes strike. The tri-colored target around it shows population growth expanding into the tornado strike zone over thirty-year increments from 1950 to 2040. The image below it similarly shows population growth increasing in a flood plain over the same period.

As populations grow and spread in areas prone to weather events, such as tornadoes and flooding, it is not only the population size that increases the potential for disaster, but how the population and built environment are distributed across the landscape.

Is the Weather Changing?

Atmospheric changes, such as global warming leading to rising ocean water temperatures, are capable of triggering changes in weather across various areas and regions. Climate science has shown that excess carbon rising into the atmosphere is subsequently absorbed by the earth’s oceans. As ocean temperatures rise, hurricanes fueled by warm water are able to gain strength, intensity and size. The longer a hurricane lingers over land, the more damage it inflicts. This was seen in the extremely active 2020 hurricane season, with named storms causing significant damage.

While a single storm cannot be tied to climate change, everything in the earth’s natural cycles is interconnected, and the increased severity and intensity of hurricanes is an effect of a warming climate.

“There is no denying that global warming is having some sort of effect on the weather,” says Mike Korn, National Property Practice Leader and Managing Principal for EPIC Insurance Brokers. “There is definitely something happening meteorologically, but it is being compounded by people moving into riskier areas.”

Korn gives Miami as an example. “Miami has always experienced tropical storms and hurricane events, but it is far more populated than it was even 20 or 40 years ago. The same storm that happened several decades ago would cause much more damage today because of the number of people living in flood and hurricane impacted zones.”

Korn also notes that the improved availability of weather data, along with the increased reporting on it, leads to a sense that things are worse weather-wise than they have ever been. “Our technology has allowed us to record everything – every tornado, every storm; where before we didn’t have that technology. So, it might appear that the frequency is higher, when in actuality it is stable because we didn’t capture as many stats in the past as we do now.”

Wildfire, Hail and Floods

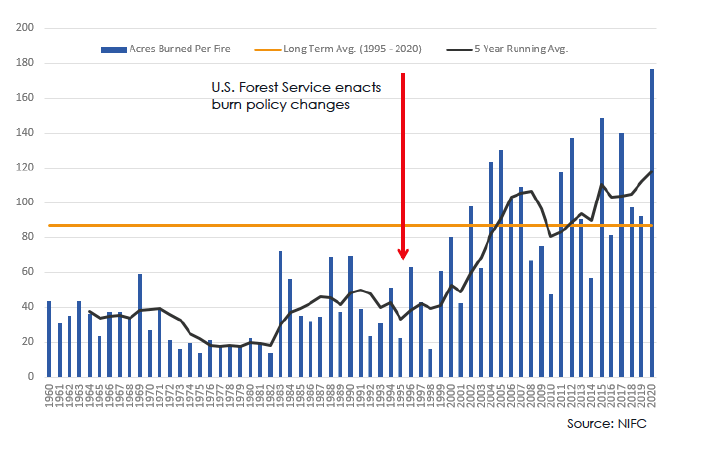

The National Interagency Fire Center (NIFC) and National Interagency Coordination Center has kept wildfire records from 1960 forward. Over that time, we are seeing larger fires burning more acres and extended fire seasons with more heat and shifts between wet and dry periods. In 1960, just above 40 acres burned per fire. Last year, that figure was nearly 180 acres burned per fire. While this trend may be impacted by prolonged drought conditions in western states, the situation is also compounded by U.S. Forest Service changes in burn policy. After policy shifted in 1995, acres burned increased from an average of just under 40 acres per fire to just under 120.

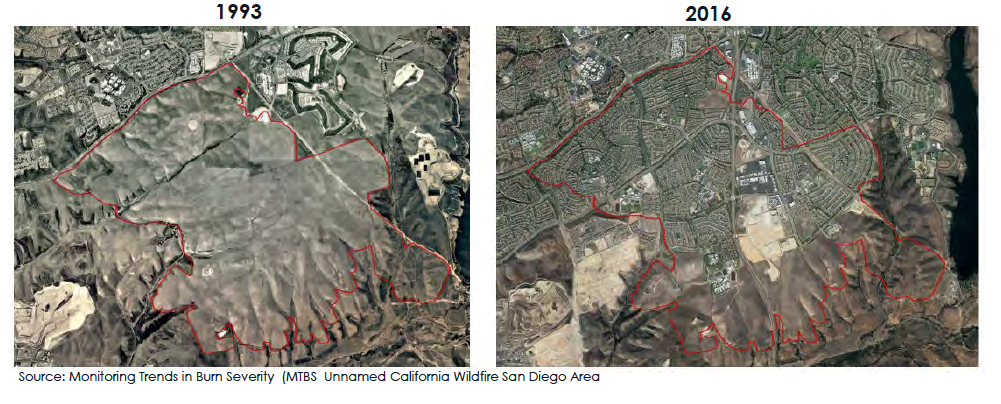

An unnamed wildfire, which occurred in San Diego in 1993, burned very few buildings, because the area was largely undeveloped. Today, as the below images show, the fire would have been considered a major wildfire loss for the insurance industry due to the increasingly populous wildland-urban interface (WUI), otherwise known as the growth of urban populations into previously wildland areas.

“Even if circumstances remain unchanged from a weather perspective, the fact that we have exposed ourselves to increased risk by moving into fire zones, and the fact that we can capture more data, compounds whatever effect the weather is actually having,” says Korn.

In terms of flooding, the Federal Emergency Management Agency (FEMA) has released tens of millions of records from the National Flood Insurance Program (NFIP) that show flood insurance claims are piling up across the nation, even in areas far from the shoreline. The single largest driver of loss in flood damage claims is hurricanes. The percentage of land area in the contiguous 48 states, where a much greater than normal portion of total annual precipitation has increased, has come from extreme single day precipitation events, such as hurricanes and tornadoes.

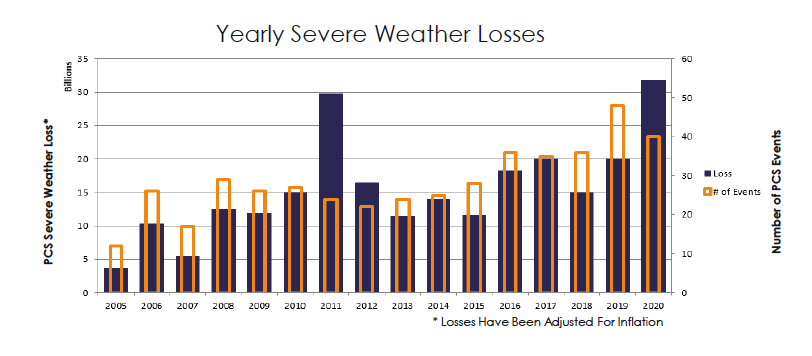

Of more significance on the severe weather losses was a derecho occurring in Iowa and other Midwestern states in 2020. There were fewer significant weather events in 2020, but much greater loss, as the following image shows, due to the derecho. Derechos are particularly destructive because of the walls of fierce wind they create, and the hundreds of miles of damage they leave in their wake, as they sweep across plains states.

Counts of tornadoes, hail and wind are all below the historical mean, and no severe weather peril is above the mean so far in 2021. Examination of the data leads to the conclusion that damage and loss will vary from one region to another.

“When we talk about global warming and changes in the weather, that doesn’t mean drought for everybody, or more rain for everyone, or warmer temperatures for all of us,” says Korn. “Climate changes relative to where each geography is now. Certain areas will experience more rain than before, while others, like California, will become drier than ever.”

According to Andrew Siffert, Senior Meteorologist for the BMS Group, the weather worth worrying about is wildfire, wind, and hail, since size and damage trends there are increasing. Loss values from such weather is increasing as storms move East to more populated areas. Tornadic activity remains normal. Flooding risk varies by region and is impacted by poor urban planning that brings higher population levels into areas likely to experience flooding.

Weather impacts all business, but shouldn’t be used as an excuse for loss. Risk should be expected and while insurance is a critical tool in limiting risk, it is important to understand that weather can have a large influence on insurance market cycles. Several years of costly disasters and social factors have created compound losses for insurers and driven up the cost of coverage overall.

Weak underwriting results, modest investment returns and shrinking reserve releases have pushed return on capital into low single figures, well below the eight percent average cost of capital. With interest rates at historical lows and yield hard to come by, responses must come from underwriting for insurers. A need to price risk correctly has created a hardening market, despite the presence of abundant capital.

After two years of a rapidly hardening market, there are signs of moderation and slowing of price increases. “Even carriers that haven’t added capacity, are more willing to use the capacity they have on the books,” says Korn. “If you can expand the participation of a carrier that is lower priced in a certain area, it might drive the overall pricing of the program down. And if you structure things properly, you can lower the composite rate. Still, nothing replaces the value of good, old fashioned brokering based on good data and strong relationships with underwriters and carriers.”

How Underwriters Interpret Weather Change

Underwriters use catastrophe models like RMS and AIR, among others. Many insurers have their own proprietary models and have begun building in factors to account for global warming. Still, the data is somewhat speculative, according to Korn.

“They look to predictive modeling for factors like storm surge and hurricane intensity to try to determine how far inland hurricanes will move in areas like Houston and others commonly impacted by hurricanes. However, we understand that things like climate change within a much longer timeframe than weather, which changes from year to year. There can be a danger in looking at the polar vortex-induced freeze that crippled Texas in February of this year, and assuming it will happen every year for the next ten years. We can’t look at one or two or even five years. We have to look for trends occurring over decades.”

Korn says EPIC licenses the catastrophe models to see exactly what underwriters see, and to add secondary characteristic data to them to provide a more accurate picture for clients seeking new coverage or renewals.

“It’s all about the data for underwriters. The more accurate the model, the more accurate the pricing will be. We go beyond the default data input to provide a specific picture of a client’s risk-mitigating factors. This can include information on roof tie downs, corner flashings, window coverings and how securely air conditioning units are secured to the top of a client’s building. We present that information to underwriters to seek more favorable terms for clients.”

Korn says this action is critical in achieving savings for clients, since models generate average annual loss figures that underwriters base premium calculations upon. When that risk is modeled more accurately, the average loss decreases, along with the resultant premium recommendations.

Preparing for Insurance Renewals

Early preparation and detailed data is critical in obtaining favorable renewal results. A smart action is to hire a third party loss control firm to conduct advance inspections on properties. Additionally, it is important to understand that underwriters are inundated with coverage submissions, and with Home Office referrals taking on greater significance, clients that provide detailed submissions with accurate, ready-to-use data, make it through the underwriting process much more efficiently.

Rather than renewing the same coverage at the same rate, insureds should push carriers to provide better rates based on more a more accurate picture of actual risk.

“Planning makes a difference. Do more than provide bare bones information,” says Korn. “Package the risk in the right way to go to the front of the line and get the results you want.”

Contact an EPIC broker for more information.

CORONAVIRUS RESOURCES

This information is also discussed in-depth in a recent webinar hosted by EPIC’s Mike Korn, and featuring panelists from both EPIC and BMS Group.

Sign up for our Emergency Response Alerts

With this subscription, you’ll receive important updates from our team as we continue to cover global outbreaks and natural disasters impacting the business community, both locally and abroad.