EPIC Risk Advisory Bulletin

Volume 1, Issue 1

Coronavirus is an important and serious matter, both globally and in the United States. At EPIC, we have assembled a team to provide regular updates containing information and links to resources to help our clients respond to challenges associated with coronavirus.

The topics addressed in this publication include:

- General information about coronavirus

- Supply chain and business risks

- Insurance products and coverage information

- Business continuity, planning, and preparedness

- Human resource policies and practices

Recognizing that conditions will continue to evolve and change, we encourage you to reach out to your EPIC service team members with specific concerns and questions about how your coverage may or may not respond. Analyzing whether or not existing insurance policies provide coverage for losses is a critical early step. Business interruption, commercial general liability, medical malpractice, property, workers’ compensation, D&O and E&O policies all may potentially provide coverage and should be examined within the context of coronavirus. Litigation, insurance claims and coverage disputes are all anticipated outcomes.

The following information is intended to provide a high-level overview of critical areas of concern for businesses around coronavirus. Consult your EPIC insurance broker for guidance.

General Information on Coronavirus

The best source for timely information on coronavirus is the Centers for Disease Control and Prevention (CDC) and the World Health Organization (WHO). Specific information on how a particular state is responding to coronavirus may also be available at state and county health department websites.

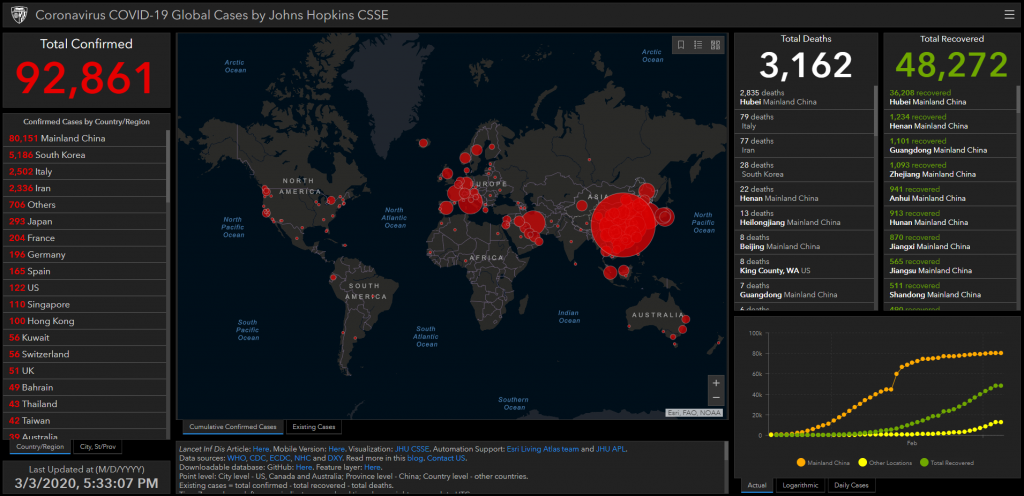

As the number of cases continue to grow internationally, there is evidence that “community spread” and confirmed cases with unknown origin and no ties to international travel will increase in the United States. Outside of China, South Korea, Italy, and Iran were the first to experience large-scale community spread, prompting the CDC to issue level-three travel warnings to these countries. Now in the United States, Washington, California, New York and additional states have reported such cases. Organizations are expected to take measures to avoid mass gatherings in cities where outbreaks are expanding.

Supply Chain and Business Risks

To understand the potential implications of global business disruption and supply chain dislocation, it is necessary to consider the specific transmission characteristics of coronavirus. A Chinese medical study published in February dispelled the importance of disease tracing for coronavirus, outlining a 20-year-old woman from Wuhan who was asymptomatic and traveled 400 miles to visit her relatives. Five of her relatives became ill, several with pneumonia. She remained asymptomatic but tested positive.

Asymptomatic transmission explains the emergence of super-spreaders, who may unwittingly infect a large number of others. The economic implications of asymptomatic transmission are enormous and far-reaching. The fact that coronavirus can be spread asymptomatically means that no one can be confident of being safe from contagion in any social situation, whether at work, commuting, or in any public space.

Fear of contagion will inevitably take an economic toll, as risk aversion will lead to the avoidance of common activities that fuel the global economy. Many business sectors will be severely impacted, as production schedules are reduced in accord with lower demand, and a lack of supply inputs. Major disruptions in supply chains will be felt across many industries, from manufacturing to tech and retail.

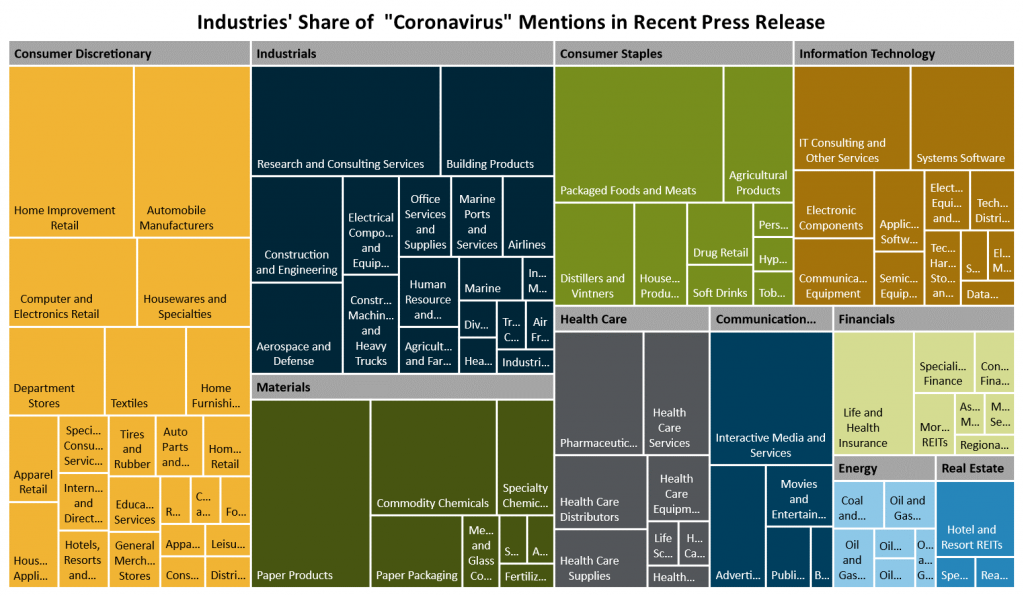

A survey conducted by EPIC on the number of public companies mentioning “coronavirus” in recent press releases (and illustrated below) indicates that entities across all industries are being vigilant of the risks the epidemic poses to their operations. As of March 4, companies in the consumer discretionary sector, which includes retail, hotel and leisure, have the most mentions of coronavirus. Around the world, conferences, concerts and sporting events have been canceled under precautionary measures. These cancellations, along with corporate travel restrictions, are having a major impact on the hotel and leisure industry.

There has not been an infectious disease crisis of this scale since the great pandemic of 1918-1919. The escalation of cases outside mainland China in late February is a stark reminder that it is still early in this evolving crisis.

Source: LifeRisks Novel Coronavirus (SARS-CoV-2/COVID-19) February 26, 2020 Edition 2 (Figures and perspectives are as of publication date). Risk Management Solutions, Inc. 7575 Gateway Boulevard, Suite 300, Newark, CA 94560 USA http://support.rms.com/

Insurance Products and Coverage Issues

With heightened awareness around coronavirus, there are many questions as to whether this virus constitutes a “communicable disease” as defined by specific policies. The answer is “yes,” coverage for communicable disease is included in some policies. Keep in mind, however, that there are additional conditions that must be present to trigger coverage.

People everywhere are assessing the potential risks – medical, scientific and financial – that could arise if the virus spreads beyond contained points. Previous worldwide viral infections caused tens of billions of dollars in losses, and similar losses could be expected from coronavirus.

Claims arising out of or relating to the coronavirus epidemic could have an impact on a wide range of policies and coverages. Because the ultimate impact of the epidemic – and the resulting losses – are currently unknown, Insureds may search for coverage (even in policies unintended for such losses) to help offset damages and risks.

Policyholders are expected to bring many types of first-party claims, including: Business Interruption; Event Cancellation; Environmental Impairment; Workers’ Compensation; Political Risk; Employer Claims; Travel Insurance/Trip Cancellation; Medical Expenses and more.

Coronavirus may also lead to specific third-party claims against Insureds for which insureds may seek coverage, including the following:

- Directors and officers liability: Shareholder claims relative to D&O decisions leading to losses/failure to disclose risks.

- Commercial property and general liability claims: Policies that cover losses resulting from bodily injury or property damage caused by infectious diseases may receive claims. See below for further information on property coverage.

- Medical malpractice claims: Failure to properly diagnose, quarantine, treat or limit exposure to coronavirus.

- Claims against common carriers: Failure to prevent exposure or to warn travelers of the risks of exposure.

Insurance carriers are being counseled and may be changing coverage to address, exclude, or limit exposures to coronavirus-type claims. Carriers may try to add, broaden or “clarify” exclusions, or sublimit exposures on renewals or new business.

Property Coverage Issues and Coronavirus

The outbreak of coronavirus has prompted questions of how Property insurance policies might respond to claims stemming from business losses. Specific Property and associated Business Interruption considerations include the following:

- Direct physical damage to Insured property

- Decontamination of Insured property

- Loss of income

- Contingent business interruption

- Stable workforce

- Civil authority issued

- Employers’ enforcement of specific corporate and human resources policies

Historically, Property all-risk policies would not provide coverage for this exposure. Property insurance needs physical loss or damage caused by an insured peril to trigger coverage. In the majority of policies, diseases and viruses are not considered insured perils and are specifically excluded under the Contamination exclusion.

There are exceptions, as a handful of companies have included coverage for communicable infectious exposure, though limited in scope. Conditions typically require that there must be actual, not suspected, presence of a communicable disease on the Insured site. The coverage may pay for the cost of cleaning and disposing of contaminated property. The Business Interruption coverage may indemnify for the time it takes to clean up. When coverage is granted for communicable disease, carriers are providing a very small sublimit of usually less than five million dollars.

Following the outbreak of coronavirus, Insurance Services Office (ISO) has drafted two Communicable Disease coverage endorsements that intend to provide limited cover once approved. Regardless, Insurers may choose not to provide the coverage.

While supply chains around the world have been impacted significantly, the repercussions will last even after the outbreak has been contained. Property policies address supply chain exposures in clauses such as Contingent Business Interruption, Civil Authority, Ingress and Egress and Logistics Extra Expense.

As addressed above, in order for coverage to be triggered under the Property policy, it requires direct physical loss or damage by a covered peril. As most Property policies do not consider disease or virus to be covered perils, the associated time element clauses in the policy will not apply. Even with a specific Infectious or Communicable Disease coverage clause in the policy, coverage is limited to actual exposure at an owned location. An occurrence at a supplier or customer location will not trigger coverage.

Policy wording will be tested as the effects of coronavirus work their way around the world and through the insurance industry. Even if policies do not contain specific coverage for disease, we recommend the following:

- Track any contamination that impacts your specific properties, or those of your suppliers or customers

- Record any impact on operations, revenues and/or extra expenses incurred due to the virus

- Work with your brokers and claim consultants to do an extensive review of your coverages and evaluate the specific facts that impact affected businesses

Again, contact your EPIC broker for assistance with specific policy coverage questions.

Business Continuity, Planning, and Preparedness

The purpose of a business continuity plan (BCP) is to provide for the continuation of critical business functions and recovery in the event that an emergency or crisis occurs. The coronavirus epidemic is such a crisis. Ensuring your organization handles it well requires having a business continuity plan in place to address it.

Create a Business Continuity Plan (BCP) for Coronavirus

The BCP is a strategic approach that brings business departments together to create a transparent process that follows several strategic steps. These include project initiation, risk assessment, strategy development, plan development, emergency communications, awareness/training and coordination with public authorities when applicable.

The BCP outlines the actions to be taken during and after a disaster, and the process for each department to follow in their recovery to normal business operations.

The goals of the BCP should include the following:

- Create a Business Continuity Committee and determine its objectives.

- Form and outline the goals of your Business Continuity Management program.

- Determine the scope of your Business Continuity Plan.

- Put in place an emergency management process.

Business Continuity Management is a holistic process that identifies potential impacts that threaten an organization. It provides a framework for building resilience with the capability for an effective response that safeguards the interests of key stakeholders, reputation and value-creating activities. The next issue of this publication will take a closer look at BCP and offer helpful tools.

Human Resource Policies and Practices

The first step in managing the coronavirus epidemic is to create a response plan for the organization. This includes creating a process for reaching employees through combinations of emails, intranet postings, flyers/posters, leader talking points, FAQs, or a website situation room. The plan should identify simple key messages and outline a reliable process for providing updates and collecting feedback from employees.

It is essential to keep an up-to-date list of employee phone numbers, physical addresses, and email addresses. There also must be processes for reaching external stakeholders, customers, media, shareholders, suppliers, local community, health care providers, analysts, union representatives, and more.

What to Say to Employees About Coronavirus:

First, state the facts. Connect employees to timely, accurate information from the CDC, WHO and your state and county health departments.

Provide clear instructions about what to do if employees suspect they have been exposed to coronavirus.

Demystify the fear and outline the steps the organization is taking on behalf of its employees. Communicate the facts from authoritative resources on how coronavirus is spread and how to avoid infection.

Clearly articulate and communicate preventive actions the organization is taking to avert or contain transmission of coronavirus at work (focus on technology and techniques for employee safety, hygiene, biohazard disposal and more).

Promote safety steps employees can take at work. Use posters, memos, emails, intranet postings, supervisor talking points, FAQs and more to promote preventive actions employees can take, such as hygiene and avoidance. Share and promote WHO and CDC recommendations.

Describe the impact on your organization. Describe the potential impact of an outbreak on your operations, services, travel, supply chain, business, revenues, and more, so employees can plan accordingly.

Summarize company policies and positions. Describe health plan coverage (both preventative and treatment) and address attendance, paid time off, payroll continuation, and travel and group meetings.

Share work-from-home policies. One of the most effective strategies for limiting the spread of contagion among employees is to reduce human-to-human contact. If your organization supports telecommuting practices, clearly articulate procedures and expectations employees should follow.

Promote safe travel policies. Consider the organization’s stance on employee travel and restrictions. Promote alternatives to travel, such as web conferencing and phone meetings. If employees must travel, offer clear guidance on safety protocols, augmenting with guidance from the CDC, U.S. State Department and WHO.

Finally, address leaves of absence. If coronavirus does become a pandemic, employers may need to consider how the Family and Medical Leave Act of 1993 (FMLA) may apply.

While this list is not inclusive, it provides a good place to start with how to handle the human resources implications and action steps your organization must consider taking around coronavirus.

For further guidance on how to prepare employees for coronavirus, read Agility Recovery’s article which outlines pandemic plan strategies that may be helpful.

Conclusion

Our understanding of coronavirus and its impact around the world is constantly evolving. This newsletter briefly touches on critical issues businesses should consider as they approach their response to coronavirus. It has likely raised more questions than provided answers.

A good next step is to reach out to your EPIC broker for more information on how your coverage may or may not respond and what risk considerations you may want to keep in mind.

For all of EPIC’s coronavirus coverage, visit epicbrokers.com/coronavirus

Disclaimer: This has been provided as an informational resource for EPIC clients and business partners. It is intended to provide general guidance on potential exposures and is not intended to provide medical advice or address medical concerns or specific risk circumstances. Due to the dynamic nature of infectious diseases, EPIC cannot be held liable for the guidance provided. We strongly encourage readers to seek additional safety, medical and epidemiological information from credible sources such as the Centers for Disease Control and Prevention and the World Health Organization. Regarding insurance coverage questions, whether coverage applies or a policy will respond to any risk or circumstance is subject to the specific terms and conditions of the policies and contracts at issue and underwriter determinations.

Sign up for our Emergency Response Alerts

With this subscription, you’ll receive important updates from our team as we continue to cover global outbreaks and natural disasters impacting the business community, both locally and abroad.

Related Content

Products

Risk Management

Our experienced teams take an enterprise-wide approach, consulting closely with you to identify, analyze and ...

Products

IMPACT Risk Partners, a division of EPIC

If your priority is achieving superior business results with a productive workforce, count on us to help you ...

Products

Employee Benefits Consulting

Our dedicated benefits team is focused on delivering better outcomes – to both your benefits program and ...