Viewpoints from Craig Hasday & Davin Millholland

There’s no doubt that current-year medical claims costs will be dramatically impacted by the pandemic we face. From mid-March to mid-June, we expect claims to drop precipitously. Much of this is due to medical care being viewed by many as non-essential, and between mandatory shutdowns and simple fear of exposure, medical care utilization has ground to a halt. The impact has been so acute that health insurance carriers are voluntarily rebating premiums to their policyholders. For example, Anthem is providing 10%-15% discounts worth $2.5 billion to its customers. The question is when, and possibly if, there will be a bounceback.

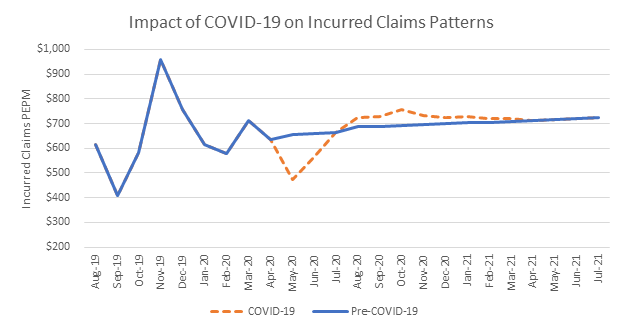

We prepared the above graphic, which shows a client’s actual claim history through March and our projections through July of next year. The blue line illustrates the normal expected claim pattern and the red dashes show adjustments made for COVID-19. While some claims will bounce back, it’s unclear how much cost will simply never be incurred.

So, what are we telling our clients?

For most, we’re expecting below-budget performance for 2020. Great news – but with a couple of caveats.

When looking at 2021 costs, many clients will see a greater percentage increase year-over-year simply due to claim deferral. The early insured renewals we’re seeing very clearly have a load built into the proposed increase.

And when we present projected increases to self-insured clients, we compare the prior-year premium equivalent rates (ghost rates) to the 2021 required rates. If 2020 is under-budget, as expected, self-insured clients will see a greater expense increase when comparing expected costs in 2021 to the actual 2020 expense which will be reflected on your income statement.

Another cautionary note for self-insured employers has to do with loss reserves. During the March-to-June claim slowdown, the claims that were paid were likely incurred 30-45 days earlier. Some clients have been asking about using medical plan reserve take-downs to offset earning hits. It’s important to realize that when setting reserves as of the plan year-end (December 31), an adjustment will be needed to normalize this reserve for COVID-19, as we expect claims patterns to return to some state of “normal” after the initial wave of the pandemic has passed.

There’s a lot of volatility in these projections and they don’t consider the COVID-19 unknowns around recurrence of illness or a possible second wave of infections.

Additionally, deferral of medical care now might result in a worsening of medical conditions later. Predicting that impact would be difficult. We’re here if you need someone to walk you through the details.

For more of our coronavirus coverage, visit epicbrokers.com/coronavirus

Join the conversation – participate in our In It Together pulse surveys on our COVID-19 strategic collaboration and idea-sharing forum. Visit epicbrokers.com/insights/preparing-for-the-new-normal

Related Content

Products

Employee Benefits Consulting

Our dedicated benefits team is focused on delivering better outcomes – to both your benefits program and ...

Products

Actuarial

Our Actuarial Team provides guidance on employee benefits and health and welfare programs to help meet ...

Products

Wellbeing & Health Management

Our consultants help you create a strategy around health management that will impact your culture and your ...